Double & Triple Tops and Bottoms

Recognizing Major Reversal Patterns

Reversal patterns help traders spot when a trend may be nearing exhaustion and preparing to change direction.

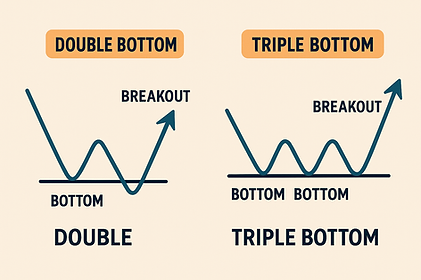

Two of the most reliable and widely used reversal formations are Double Tops/Bottoms and Triple Tops/Bottoms.

These patterns appear across all timeframes—1-minute scalps, intraday charts, swing trades, and even long-term investing.

Their strength comes from repeated failed attempts to break a key level, which signals a potential shift in market sentiment.

Double Bottom Pattern (Bullish Reversal)

A double bottom is shaped like the letter W.

It forms when a stock makes:

-

A strong drop into a new low

-

A bounce into resistance

-

A retest of the same low

-

A breakout above the bounce high

This pattern signals that sellers failed twice to break the support

level, and buyers are stepping in aggressively.

Key Characteristics

-

Two distinct lows at roughly the same price

-

A middle peak between the lows

-

Support holding firmly on the second test

-

Breakout confirmed when price exceeds the middle peak

Why It Works

The second bounce often attracts heavy buying because traders view it as a confirmation that the low is being defended.

The steeper and more aggressive the second drop, the stronger the rebound tends to be.

Triple Bottom Pattern (Stronger Bullish Reversal)

A triple bottom is similar to a double bottom but includes three tests of the same support level.

This pattern represents a more powerful reversal because:

-

Sellers failed three separate times to break support

-

Each retest traps more short sellers below the level

-

Breakout often leads to a sharp uptrend due to momentum + short covering

Structure

-

First bounce off support

-

Second bounce retests the support

-

Third bounce confirms buyer strength

-

Breakout above previous peaks begins a trend reversal

Triple bottoms produce some of the best reversal moves because they show persistent accumulation.

Double Top Pattern (Bearish Reversal)

A double top is shaped like an M and signals that buyers

are losing strength.

The pattern forms when:

-

Price pushes to a high

-

Pulls back

-

Retests the same high

-

Fails and breaks below the pullback valley

Key Characteristics

-

Two peaks at nearly the same level

-

Buying pressure weakens on the second test

-

Breakdown confirms the new bearish trend

Psychology Behind the Pattern

When buyers cannot break a high twice, confidence falls.

Sellers step in, longs exit positions, and the breakdown accelerates.

Triple Top Pattern (Stronger Bearish Reversal)

A triple top adds a third failed breakout attempt, making it a more powerful bearish signal.

Why It’s Stronger

-

Buyers fail three times at the same resistance

-

Each failure traps more longs at the top

-

Breakdown triggers both long exits and short entries

-

Often leads to a deeper, more aggressive decline

Structure

-

First peak → rejection

-

Second peak → rejection

-

Third peak → final rejection

-

Break below the valleys → trend reversal

Triple tops often form at the end of strong uptrends and signal exhaustion.

Pattern Reliability & Tips

To increase success with these patterns:

✔ Look for clear, distinct peaks or troughs

✔ Combine with volume:

High volume on breakout = strong confirmation

✔ Patterns on higher timeframes carry more weight

✔ Avoid patterns that look “too tight”—you want clean symmetry

✔ Use support/resistance levels for stop placement

These patterns become extremely powerful when combined with EMAs, VWAP, trendlines, and momentum indicators.

Key Takeaways

-

Double bottoms/tops = 2 tests of support or resistance

-

Triple bottoms/tops = 3 tests → stronger reversal signal

-

W-shaped = bullish reversal

-

M-shaped = bearish reversal

-

Confirmation comes from the break of the middle structure

-

More tests = stronger breakout or breakdown

Pro Tips - Double & Triple Tops

-

A Double Top becomes significantly stronger when the second top forms on lower volume.

-

Triple Tops often signal trend exhaustion — momentum usually weakens before the breakdown.

-

The best Double/Triple Top breakdowns happen when price rejects the neckline on a retest.

-

Look for confirmation from indicators like EMA9/EMA20 — if both are curling down, the reversal is stronger.

-

A wick into the resistance zone (fake breakout) often leads to a sharper, cleaner breakdown.

-

Identify whether the tops form under a major daily/weekly resistance level — those breakdowns have the highest follow-through.

Pro Tips - Double & Triple Bottoms

-

A Double Bottom is strongest when the second bottom forms on higher buying volume.

-

Triple Bottoms often indicate accumulation — watch for higher lows on micro-timeframes.

-

The safest confirmation is when price breaks above the neckline and retests it as support.

-

If the second bottom forms with a long lower wick, it shows strong buyer absorption.

-

Combine Double/Triple Bottoms with VWAP reclaim or EMA20 reclaim for powerful long entries.

-

Check for the pattern forming at a major higher-timeframe support level — these produce explosive reversals.